Wessex Water Services Limited (“WWSL”) has made funding available for private entities to provide high quality holistic debt advice to its customers when they apply to any of its affordability schemes (“Applications”). An entity becomes a “Funding Recipient” when its funding application is accepted by WWSL. These Holistic Debt Advice Funding Terms and Conditions (the “Debt Advice Conditions”) set out the terms and conditions on which this funding is made by WWSL to the Funding Recipients and are intended to ensure that the funding is used for the purpose for which it is awarded. These Debt Advice Conditions are binding on the submission of a funding application.

The Total Funding Amount received by the Funding Recipient will be based on the number of successful Applications that WWSL have received from the Funding Recipient during the previous financial year. The banding at https://partnerhub.wessexwater.co.uk/organisation-funding-application sets out the Total Funding Amount, which is made on a per successful Application basis.

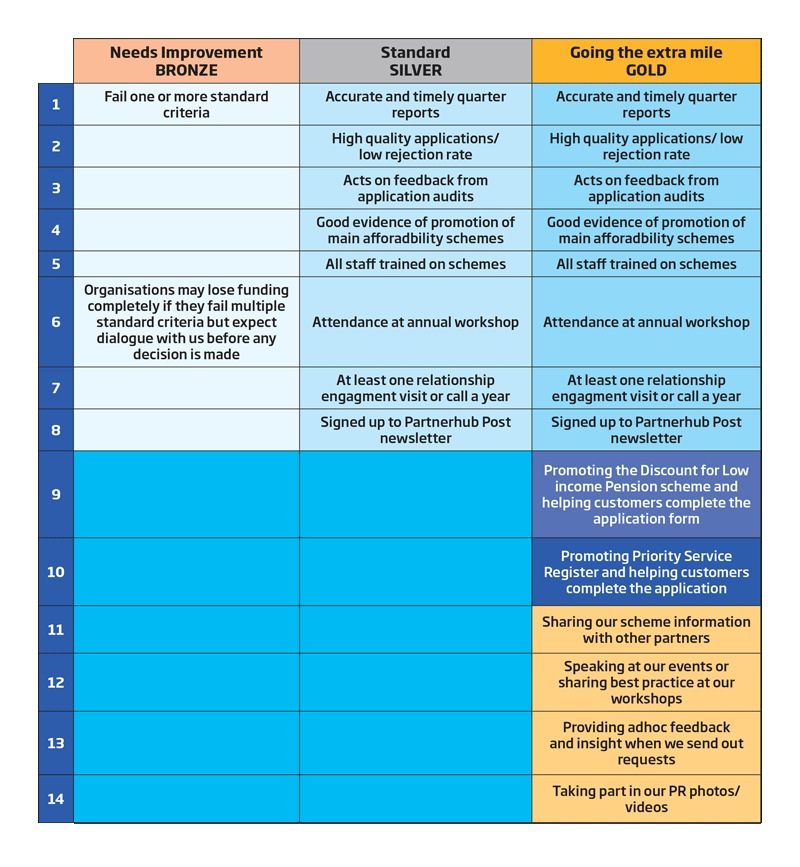

The chart below sets forth the level of services that the Funding Recipient must provide in order to receive each level of funding:

The allocation of tiers to the funding is in the absolute discretion of WWSL.

The payment of the Total Funding Amount will be made once per year. WWSL will track the Applications made by the Funding Recipient and pay the Total Funding Amount accordingly. Payments are made in advance for each year and are based on the previous year’s successful Applications. WWSL reserves the right not to pay any amount of the funding if it considers that the Applications submitted by the Funding Recipient are incomplete, incorrect or otherwise of poor quality, or if the Funding Recipient has breached its obligations under these Debt Advice Conditions. WWSL will not take unsuccessful Applications into account when allocating funding or tiers.

WWSL, in its absolute discretion, reserves the right to terminate the participation of any Funding Recipient in the Holistic Debt Funding programme if it receives multiple applications that it considers are of poor quality. In addition, WWSL may reduce the total funding available for Holistic Debt Advice for any year or phase the funding payment entirely at any time.

Each funding period is for a length of one year after application. Continued funding is available yearly but Funding Recipients must reapply using the online application form. Other terms apply.

Funding Recipient obligations

The Funding Recipient may only use the funding provided by WWSL to assist its customers with debt advice and to submit customer Applications to the affordability schemes held by WWSL. Funding Recipients may not use the funding for any other purpose unless this has been approved in writing by WWSL.

The Funding Recipient must submit an accurate and fully completed quarterly report on the provision of advice to customers by the deadline required by WWSL, using the pro forma provided. If a Funding Recipient has received funding in the previous financial year, and wishes to apply for continued funding, it must have submitted a Q4 report for the previous financial year to be eligible.

The Funding Recipient must promote WWSL affordability schemes during the funding period. The Funding Recipient may use promotional materials provided by the WWSL relationship manager.

The Funding Recipient must ensure that a member of its staff attends the annual workshop held by WWSL on its affordability schemes.

The Funding Recipient must permit WWSL’s relationship manager reasonable access to its staff (whether in person or by telephone) for the purpose of discussing all engagement and funding issues.

If WWSL provides feedback and advice on the quality of the Applications, the Funding Recipient will use all reasonable endeavours to put the advice into practice.

The Funding Recipient must ensure that all of its staff (paid or voluntary) are adequately trained on WWSL affordability schemes. The Funding Recipient is fully responsible for its staff and WWSL accepts no liability for any consequences, whether direct or indirect, that may come about from the Funding Recipient providing advice to its customer, any use that it makes of the funding or from the withdrawal, withholding, suspension or reduction of the funding.

The Funding Recipient must comply at all times with all applicable anti-bribery laws and all laws relating to the processing of personal data and privacy including the Data Protection Act 2018, the UK GDPR and the guidance and codes of practice issued by the Information Commissioner.

The Funding Recipient will not make any public announcement or use the WWSL logo or name without the prior written agreement of WWSL.

General terms and conditions

The Funding Recipient and WWSL shall not disclose to any person or use for any purpose any confidential information of the other party during any funding period. These confidentiality obligations shall cease to apply to any confidential information which may, through no fault of the party concerned, properly come into the public domain or which is required to be disclosed by law. These confidentiality obligations will continue to apply for two years after the Funding Recipient is no longer eligible to receive funding under these Debt Advice Conditions.

The Funding Recipient may not, without the prior written consent of WWSL, assign, transfer, novate or in any other way dispose of the whole or any part of this agreement to any third party.

This agreement is governed by and will be construed in accordance with the law of England and Wales and the parties irrevocably submit to the exclusive jurisdiction of the English courts.